What is the Backdoor Roth IRA Process?

Designed by Freepik

Backdoor Roth IRA: Summary

The Backdoor Roth IRA is a tax strategy that allows high income people who exceed the income limits for Roth IRAs to indirectly make contributions by converting a traditional IRA into a Roth IRA. This is done in 2 steps: (1) Contribute after-tax dollars into a traditional IRA (2) Convert this traditional IRA into a Roth IRA.

Backdoor Roth IRA Contribution limits 2024/ 2025

In 2024, the maximum Roth IRA contribution limits are $7,000 for those under age 50 and $8,000 for 50 and above. In 2025 the maximum Roth IRA contributions limits are the same as for 2024.

Roth IRA & Income Limits

The Roth IRA is a tax advantaged retirement account in which you put in after-tax dollars towards retirement. The earnings and contributions grow tax-free and can be withdrawn tax free starting at age 59 ½ , provided the money has been in the Roth account for at least 5 years. This means that the only time you pay taxes is when you put after-tax dollars into the Roth. But afterwards you do not have to pay any taxes on the asset growth or withdrawals.

However, the Roth IRAs have income limits and are not available to high earners whose income exceeds this limit.

In 2024, the income limits for Roth IRAs are as follows:

- Single tax filers: Modified adjusted gross income is not more than $161,000.

- Married filing jointly: Modified adjusted gross income is $240,000

In 2025 the income limits for Roth IRAs are as follows:

- Single tax filers: Modified adjusted gross income is not more than $165,000.

- Married filing jointly: Modified adjusted gross income is $246,000

As you can see, high earners whose incomes exceed these limits cannot tap into the benefit of Roth IRAs. This is where the Backdoor Roth strategy comes in.

The Backdoor Roth is not a type of retirement account. It is an indirect ‘backdoor’ strategy that allows high earners to put their money into the Roth IRA by making contributions into a traditional IRA and then converting this into a Roth IRA.

Step-by-Step Backdoor Roth IRA Steps (Form 8606 Considerations)

Step 1a: Contribute to a traditional IRA

You can open an IRA account on Fidelity, Vanguard or similar provider. If you already have an account, just log in and make the required contribution amount into the traditional IRA.

Step 1b: Choose money-market accounts or cash

This ensures that your money does not appreciate before you complete the Roth conversion. You will have to pay taxes on any appreciation that happens before you complete the conversion, so it is best to keep the money in cash until you complete the conversion.

Step 2a: Convert your traditional IRA to a Roth IRA.

Convert the traditional IRA into a Roth by transferring funds from the IRA account to a Roth account from the same provider/ fund company. Open a Roth IRA account with the same company. You can do the conversion right after step 1a, but some companies will not let you do the Roth conversion on the same day. You may have to do it the next day or a few days out.

Step 2b: Select an investment for the contributions in your Roth IRA account

Your provider will offer multiple fund options such as a Target Retirement Plan or S&P index funds, including approaches like The Boglehead Investment Approach. Choose a fund option based on your asset allocation and risk management goals.

That’s all. You are all set now!

Filing Form 8606 for Backdoor Roth IRA

While filing taxes, remember to fill out Form 8606 for each spouse who is filing taxes. Form 8606 is filled out to report 4 types of transactions:

(1) Non-deductible contributions to a traditional IRA

(2) Distributions from a traditional, SEP IRA if you have made non-deductible contributions to a traditional IRA in this year.

(3) Conversions from traditional or SEP IRA to Roth IRA

(4) Distributions from a Roth IRA before age of 59 ½ or before the account has been open 5 years.

As you can see, you have to fill out this form if you made the Roth conversion. Make sure you do it if you file taxes yourself or ensure that your tax advisor does this.

Here are some quick tips.

Line 1: Enter your IRA non-deductible contributions in Line 1. If you maxed out at $7000, then enter this number. This amount is non-taxable since you are putting in post-tax contributions.

Line 2: Enter 0 if you have been carrying $0 amount in IRA as of Dec 31 of the previous year.

Line 6: Enter value of all traditional IRAs and SEP IRAs in the current year. If you are not having any traditional or SEP IRAs, enter ‘0’.

Line 8: Enter the amount you converted from traditional or SEP IRA into Roth IRA. If you maxed out, it should be $7000 for year 2024.

What To Watch Out For With Backdoor Roth Conversion

Avoid Gains In The Traditional IRA Account While Doing The Conversion

If there are any gains on the traditional IRA before you convert to a Roth IRA, these gains are taxable. To avoid common financial pitfalls, ensure careful planning. It can also make your tax paperwork more complicated. So the best option is to choose a cash account in the temporary IRA account to avoid having any gains, and transferring funds to the Roth account as soon as possible.

Beware Of The Pro-rata Rule

If a person already has other traditional IRA accounts, then the prorate rule will kick in and this makes the tax implications more complex. The prorate rule requires that all IRA accounts – both pre-tax and post-tax- be considered as a single entity when taxes are calculated on a conversion. This means that if you already have funds in a traditional IRA and you make new contributions for a Roth conversion,you cannot guarantee that only the after-tax funds will be used for the Roth conversion.To navigate this complexity, consider using AI Budget Calculators & Tools to plan your finances efficiently. The converted amount uses both accounts proportionally.

Consider the following example:

You already have $10,000 sitting in a traditional IRA and you now contribute $7,000 for the purpose of a Roth conversion.

The calculations will be as follows;

Total funds in IRA = $10,000 +$7,000 = $17,000

Non-taxable percentage = $7,000/$17,000 = 41.1%

Therefore while you may be thinking that the entire $7,000 you are putting in is eligible to grow tax-free, in reality, only 41.1% of the $7,000 = $2,877 will be eligible to grow tax-free. Therefore, make sure you do not have any traditional IRAs and if you do, you understand the implications before you do a Backdoor Roth conversion.

Remember the 5-year Rule for Roth conversions

The 5-year rule states that you must wait until at least 5 years before you withdraw funds without penalty after a Roth conversion.

Benefits of Backdoor Roth

Allows High Earners to make Roth Contributions

The most obvious benefit is that the Roth IRA allows high earners to take advantage of Roth IRAs, something they normally would not be able to.

Money Grows Tax Free.

The backdoor Roth IRA works very similar to a standard Roth IRA. This means that you would invest post-tax dollars and the assets grow tax-free and the withdrawals are also tax-free.

No RMDs On Roth Withdrawals

Similar to a Roth IRA, Backdoor Roth IRAs do not have RMDs apply to them on withdrawals. This means that you do not have to worry about the drawbacks of RMDs, such as a higher taxable income due to lump sum withdrawals, or increases in taxable social security benefits.

Backdoor Roth Is Perfectly Legal

The Backdoor Roth is a widely used and perfectly legitimate way for high earners to take advantage of the Roth. Just make sure to follow the IRS rules and consult a tax professional if you need to.

Cons Of Backdoor Roth

Multi-Step Process

Backdoor Roth IRA can be a bit more complicated and hard to figure out the first time. There are multiple phases – (1) putting money in a traditional IRA and (2) then converting to a Roth IRA. This could take a bit of figuring out,especially for first-timers, but it is worth doing due to the benefit of letting your asset gains grow tax-free in a Roth IRA.

Funded with post-tax dollars; No Tax Savings In The Present

The backdoor Roth involves post-tax contributions. Thus high income earners do not get tax breaks at the current moment, when their income is high.

Therefore, make sure you max out all the 401K and other pre-tax retirement options before doing a Roth conversion to ensure a holistic personal financial plan.

Mega backdoor Roth Strategy

A mega backdoor strategy allows eligible people to make a transfer from a 401K to a Roth IRA or Roth 401K. The mega backdoor consists of 2 steps: (1) Make after-tax 401K contributions and (2) Convert these contributions to Roth IRA or Roth 401K.

You can do a Mega Backdoor Roth only if your employer’s plan allows this option. The IRS has set a maximum of $69,000 for (1) individual contributions, (2) employer match and (3)additional after-tax contributions. The IRS also allows an additional catch-up contribution of $7500 from age 50.

So if you max out our pre-tax 401K at $23,000 then you have a remaining $46,000 that you can put into your after-tax contributions. Of course, any employer match would reduce this $46,000 correspondingly. This is another way high earners can take advantage of the Roth IRA or Roth 401K.

However, not everyone is eligible for the Mega Backdoor Roth. The following conditions have to be met to be able to take part in the mega Backdoor Roth Strategy.

Eligibility Criteria For The Mega Backdoor Roth

- Employer plans should allow after-tax 401K contributions after the standard pre-tax contributions of $23,000 in 2024.

- Employer plans should allow Roth conversions or ‘in-service’ distributions. In service distribution means that you take money out of your employer’s 401K while employed by this company. If your employer plans allow these Roth conversions, it will let you roll over the after-tax 401K contributions into Roth IRA or Roth 401K.

Who Is the Mega Backdoor Roth Best Suited For?

People whose modified AGI is above the limits.

If your income is too high for a standard Roth, you can consider a Mega Backdoor Roth, provided your company offers this option.

People who can afford the contributions

You should earn enough income and be able to save enough that you can afford to do a Mega Backdoor Roth in addition to your pre-tax 401K. After maxing out pre-tax 401K of $23,000, you could put in an additional $46,000 in the Mega Backdoor. Of course, if you get an employer match, the amount you can contribute gets reduced by the amount of the employer match.

Conclusion

The Backdoor Roth & Mega Backdoor Roth strategies are good options for high earners who exceed the income limits stipulated for Roth IRAs. The Mega Backdoor is only available to people whose employers allow post-tax 401K contributions and Roth conversions. By following these strategies, the assets saved in these accounts will grow tax free and withdrawals are also tax free, helping you move closer to financial independence.

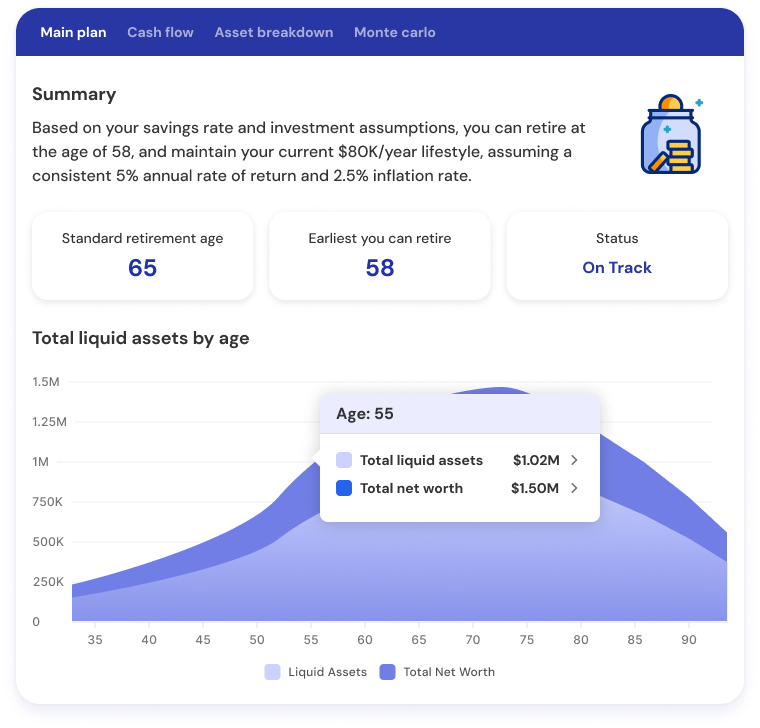

At Planwell, we are building a fully automated AI financial planner and advisor to help you make super personalized financial decisions such as how to retire early and achieve financial independence & how much house you can afford, while considering your lifestyle, retirement goals and other key factors.

We will be launching the product very soon. Stay tuned for an update. In the meantime, check out our blog posts to help you plan your finances.

- Top 5 Books For Financial Literacy: Here are the best 5 books you can read to learn the fundamentals for financial literacy.

- How to build a personal financial plan: Before you make a home purchase, make sure to build your personalized financial plan with our 10 step guide.

- How to Use AI Budget Calculators and Tools to Plan Your Finances: Take advantage of our free FIRE calculator to plan your finances more effectively.

- 5 Common Money Mistakes to Avoid: Learn about the pitfalls that could derail your early retirement plans.

- 5 Overlooked Workplace Benefits That Can Save You Money: Maximize your work benefits to boost savings and well-being.

Related Posts

About

©2023 Planwell.io