What is Planwell?

Planwell is a fully automated AI financial planner and advisor that helps individuals and families make financial decisions that are hyper personalized to their goals and lifestyle. It helps you answer important questions such as how soon you can achieve financial independence or retirement, how much house to purchase or how much you need to save to put your kids through college.

And if you are wondering whether you can afford to do that kitchen remodel and still take a vacation at Christmas, Planwell’s AI financial advisor app can help you figure that out, too. It helps you make tradeoffs between different goals and find that financial sweet spot.

Why Planwell?

Generic personal finance apps do not do a detailed analysis of one’s personal financial situation, goals and aspirations. Planwell’s AI financial planning software does all this and provides actionable recommendations to achieve one’s goals.

Before you make the biggest financial decisions of your life, use the Planwell financial advisor app to figure out how to retire early, exactly how much house to buy, or enjoy that great lifestyle you always wanted.

Benefits of Using Planwell’s AI Financial Advisor Tool

Personalized recommendations

Planwell’s AI financial advisor tool for financial planning provides personalized recommendations based on understanding your finances – income, lifestyle, goals – and crunching the numbers. For example, we can tell you exactly how much house you should buy, based on your expenses and desired lifestyle – and not just based on standard rules-of-thumb. Or if you want to spend money on travel or other interests, then you may have to spend less on buying a home - or vice versa.

What-if Scenarios

Planwell allows you to run ‘what-if’ scenarios to model your finances under different situations, eg: higher inflation or different rates of growth. You can also determine if increasing your income by a certain percentage or reducing expenses may get you closer to your goals.

Financial Decision Engine

Planwell helps you make informed decisions by crunching the numbers on your behalf and presenting you with the implications of various financial options.

You may have a lot of questions about finances such as:

- Should I buy a real estate property?

- Should I pay off debt or invest in the stock market?

- Can we retire early and pursue our passions or hobbies? How to achieve this?

- Can we afford a larger home? How does that impact lifestyle choices like travel?

- Can one parent go part-time to care for their kid?

- If we fund 100% of kids’ college, how will it impact retirement goals?

Planwell’s AI Advisor can help you make these types of decisions in just a few minutes.

Key Features of Planwell

Instant financial plans for each goal

You can choose the goals that you would like to plan for and Planwell instantly generates the financial plan for each goal, including whether you are on track to achieve the goal, and personalized recommendations to do so.

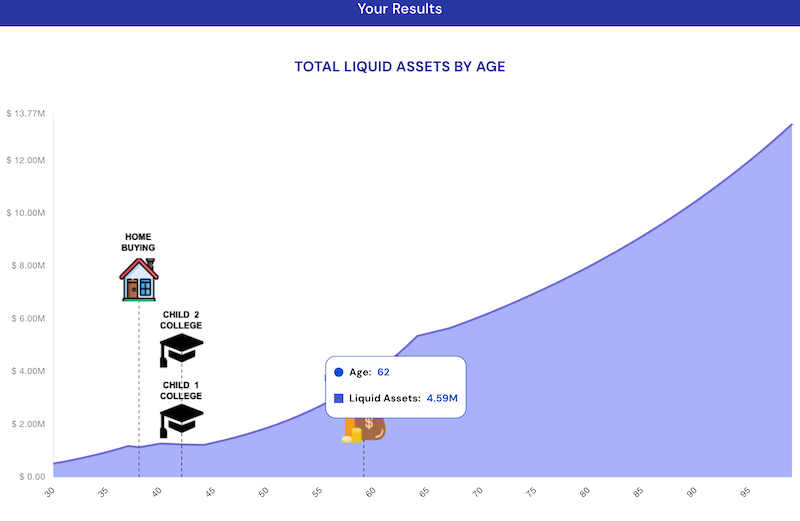

Full lifetime projection of your financial picture

Planwell projects your finances through your lifetime, including the cash flow for each year and net worth at every stage in your life. You can change the assumptions such as inflation, rates of return, and see how your finances change throughout your life.

Financial Independence and Retirement (FIRE) Readiness

Planwell tells you the earliest age you can be financially independent or retire early, based on your current lifestyle, savings and goals. It also tells you how much you should be saving in order to accomplish your retirement goals.

College Savings Planning

You can input your kids’ age, current savings and the percentage of college fees that you might want to fund. We compute how much you’d need to save additionally to be able to pay for college.

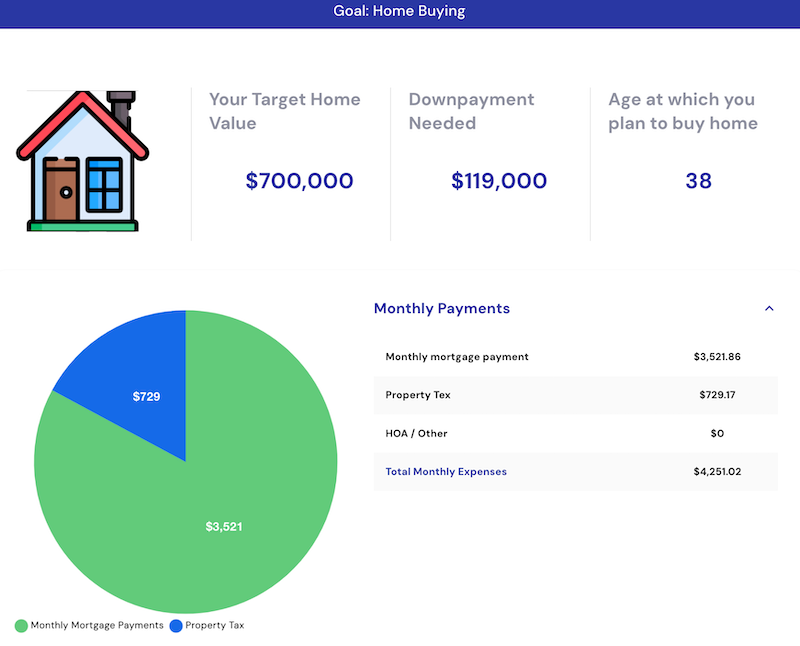

Home Buying & Home Affordability Planning

Most home affordability calculators use standard rules of thumb to tell you how much home you can afford. With Planwell, you can get a personalized recommendation of how much home you can afford, based exactly on current income, expenses and lifestyle. You can run different scenarios, such as different mortgage rates, downpayment values or even how much house you can afford if you were able to increase your income or cut expenses.

How Planwell Compares to Traditional Financial Advisors

Unbiased recommendations

Planwell’s recommendations are unbiased and based purely on crunching the data. We do not try to push you towards high-fee products or charge any hidden fees.

Cost effectiveness

Because the software is fully automated, we can keep costs down to a fraction of what a traditional financial planner or advisor would charge.

Instant results

You can input your data and get results within minutes and make decisions quickly. You do not need multiple meetings to get back your results – a process that traditionally takes weeks.

Who Can Benefit from Planwell?

Goal oriented individuals and families

Individuals and families who want to map out all their finances and work towards achieving financial goals will benefit from Planwell. Planwell helps you see your full current financial picture and map out your future finances based on assumptions about inflation and wage growth.

People going through key lifestyle stages

People who are at a stage where they have to make important financial decisions or commitments, such as buying a home, or planning for a child, or thinking about working part time, will especially benefit from crunching the numbers with Planwell.

They can also use the insights and recommendations to have meaningful discussions with their family about what priorities are important – and which ones are not.

How to Get Started with Planwell’s AI financial planning app?

We will be launching the product very soon. Stay tuned for an update. In the meantime, check out our blog posts to help you plan your finances.

- How to build a personal financial plan: Before you make a home purchase, make sure to build your personalized financial plan with our 10 step guide.

- How to Retire Early and Achieve Financial Independence: Deep dive into strategies that can help you retire early.

- How to Use AI Budget Calculators and Tools to Plan Your Finances: Take advantage of modern technology to plan your finances more effectively.

- 5 Common Money Mistakes to Avoid: Learn about the pitfalls that could derail your early retirement plans.

- 5 Overlooked Workplace Benefits That Can Save You Money: Maximize your work benefits to boost savings and well-being.

- 8 Financial Planning Tips for Young Adults: Start your financial planning journey early with these essential tips.

- How to Build a Personal Financial Plan: A 10-Step Guide: A comprehensive guide to building a financial plan tailored to your goals.

Related Posts

About

©2023 Planwell.io