What is Barista FIRE? How to Achieve Early Retirement While Working Part-time

What is Barista FIRE?

Barista FIRE refers to a type of Financial Independence, Early Retirement (FIRE) approach in which you work part-time after retirement to fund some of your expenses. This means you would require a lower net worth for retiring, and you may be able to quit the career treadmill sooner and retire earlier. The term ‘Barista’ is used to denote a part-time job such as working as a barista in a coffee shop which allows you to earn an income without the stress of the corporate rat race.

Review our blog post on the top 5 books to help you achieve your Financial Independence, Retire Early (FIRE) milestone.

Benefits of Barista FIRE

Lower net worth is needed at retirement age

Since you will work and earn an income in retirement, you do not need to have as high a net worth at retirement as if you did not work at all. This may also allow you to retire earlier from your demanding corporate job.

Financial security

Having an income post-retirement also means that you will not need to dip into your net worth to fund your expenses. This may also help you avoid tapping into tax-advantaged retirement accounts sooner than needed, and thereby avoid paying early withdrawal penalties.

Access to benefits such as health insurance

Many part-time jobs also come with benefits such as health insurance. This can be of great help in lowering your retirement health insurance costs and reduce risk in retiring early. However, not all part time jobs do pay health insurance or other benefits, so do your due diligence to make sure that the post-retirement jobs you have in mind will actually deliver on this benefit.

Keep yourself busy, avoid boredom

Retiring early sounds great in theory. But most people get bored with full retirement, especially when their contemporaries are all busy with their careers. Working a low stress job or part-time keeps you busy and helps avoid boredom in retirement.

Work a less stressful job

You can exit the corporate rat race, but work in a low stress job. For many people, this may be the best of both worlds.

Key considerations with Barista FIRE

1. You will still work in retirement

Barista-FIRE means that you do have to keep working after retirement,though this may be part-time or a low stress job. Since your FIRE number has been calculated with the part-time work as an assumption, you will likely not have the luxury to stop working. So be sure that you will want to keep working before you make the decision to Barista FIRE.

2. Benefits may not be guaranteed

Not all part time work comes with healthcare or other benefits. So you need to research your planned post-retirement career and make sure these assumptions hold true.

How to Determine Your Barista FIRE Financial Goal?

1. Calculate expenses in retirement

Start by figuring out the annual expenses needed in your retirement years. You can do this by estimating the percentage of your current expenses that you will need in retirement. Factor in the type of lifestyle that you want in your early retirement. Do you expect to travel? Will you need to pay for kids’ college in your retirement years? Will you still carry your mortgage? Don’t forget to factor in healthcare costs as well.

2. Subtract the expected income in retirement years from your expenses

This is the step that differentiates a regular FIRE calculation from the Barista FIRE calculation. After you have estimated your annual retirement expenses, you now need to reduce this by the income you expect to make from your ‘Barista FIRE’ type job. This will give you the annual expense number that needs to be funded by your net worth. As you can see, the required net worth will be lower for Barista FIRE due to factoring in the side income.

3. Calculate the net worth needed to fund the expenses in retirement.

Calculate the net worth at retirement age needed to fund your retirement expenses each year until the end of life. An alternative approach would be to use the 4% withdrawal rule, in which you use a flat rule of thumb like drawing down 4% of your net worth each year.

4. Find out how much to save every year to achieve your Barista FIRE number

Finally, figure out how much you need to save every year to achieve your barista FIRE net worth number.

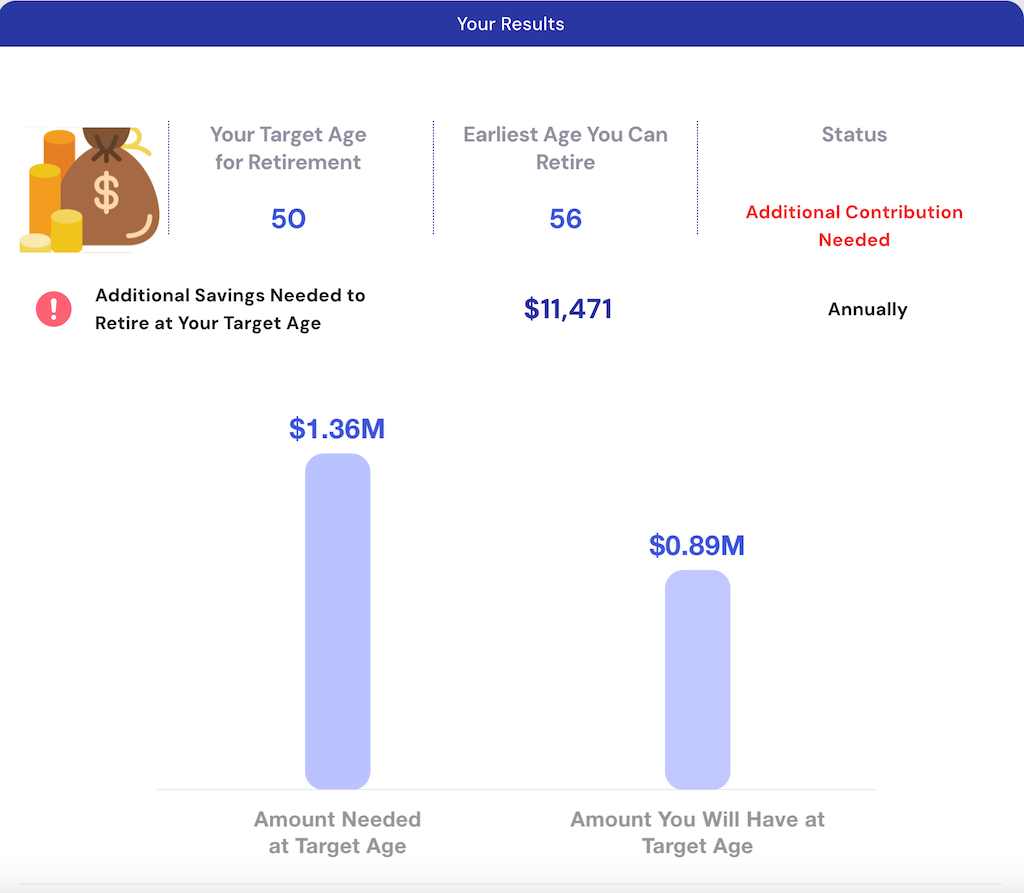

Use the Planwell FIRE calculator to calculate your Barista FIRE age and required net worth. Make sure to put in your ‘Side income in retirement’ to crunch the numbers accurately.

How to achieve Barista FIRE

Now that you have calculated the amount you need to save every year, here are some steps to achieve these savings and get to Barista FIRE.

1. Reduce spending

Not surprising, cutting your spending is the best way to boost your savings and get to early retirement. As we discussed in our blog post on How to Retire Early and Achieve Financial Independence, your savings rate is determined by your current expenses and lifestyle.

2. Research Barista FIRE jobs

Research the kinds of jobs that you may be interested in retirement. Make sure they will be really interesting to you. Also research the benefits you would likely get from these jobs (or not!). You want to go into Barista FIRE with your eyes wide open about the income and benefits likely from part-time work and an idea of whether you will actually enjoy the work.

3. Invest strategically

Think through your asset allocations and investment options to earn an optimal rate of return that enables early retirement. However, remember that higher returns are correlated with higher risk.

Coast FIRE vs Barista FIRE

Coast FIRE

- With Coast FIRE, you build enough assets early in your career by saving aggressively and let it compound until retirement.

- You retire at standard retirement age, but work a less stressful job between achieving your Coast FIRE number and actual retirement.

- Coast FIRE is for people who want to work until normal retirement age but in a less stressful job.

Barista FIRE

- You retire early and don’t wait for retirement age.

- You work a low stress job/ part time after retirement to pay for part of living expenses.

- Barista FIRE is for people who want to retire early but are open to working a less stressful job in retirement.

FIRE vs Barista FIRE

FIRE

- You do not work in retirement. This requires much more frugality and aggressive savings early on.

- Your FIRE number is likely to be higher since you will not work in retirement and have to depend largely on savings.

Barista FIRE

- You work part time or a low stress job in retirement.

- You can target a lower FIRE number, since you will have some earnings in retirement.

How can Planwell help with Barista FIRE?

Planwell’s FIRE calculator can help you determine your Barista FIRE net worth and age. The FIRE calculator considers your income in retirement to calculate Barista FIRE. You can also use the FIRE calculator to compare the FIRE scenario vs Barista FIRE scenarios and make an informed decision while planning your financial independence. Moreover, you can model different rates of return, inflation, wage growth and variables to get your Barista FIRE number in different macro-economic conditions.

Planwell is also building our fully personalized financial planning app to help you plan your finances comprehensively, including financial independence, retirement/ early retirement and a host of other financial goals such as home buying, kids college and real estate.

Conclusion

Barista FIRE is a good option for people who are open to working part-time in retirement and using this income to fund some of their expenses. Therefore, they will need a lower net worth to retire and can even retire a few years earlier than if they did not plan to work at all in retirement.

At Planwell, we are building a fully automated AI financial planner and advisor to help you make super personalized financial decisions such as how much house you can afford, while considering your lifestyle, retirement goals and other key factors.

We will be launching the product very soon. Stay tuned for an update. In the meantime, check out our blog posts to help you plan your finances.

- What is Coast FIRE? Find out how to Coast Your Way to Financial Independence.

- How to retire early and achieve financial independence: Tips to retire early and achieve FIRE (Financial Independence, Retire Early)

- How to build a personal financial plan: Before you make a home purchase, make sure to build your personalized financial plan with our 10 step guide.

- How to Use AI Budget Calculators and Tools to Plan Your Finances: Take advantage of our free FIRE calculator to plan your finances more effectively.

- 5 Common Money Mistakes to Avoid: Learn about the pitfalls that could derail your early retirement plans.

Related Posts

About

©2023 Planwell.io