Real estate is an increasingly popular investment for people interested in financial independence. The income from real estate investments can supplement one’s income and in some cases even fully replace it, enabling people to retire early. Real estate investing also helps diversify one’s portfolio and build long-term wealth through property appreciation and rental income.

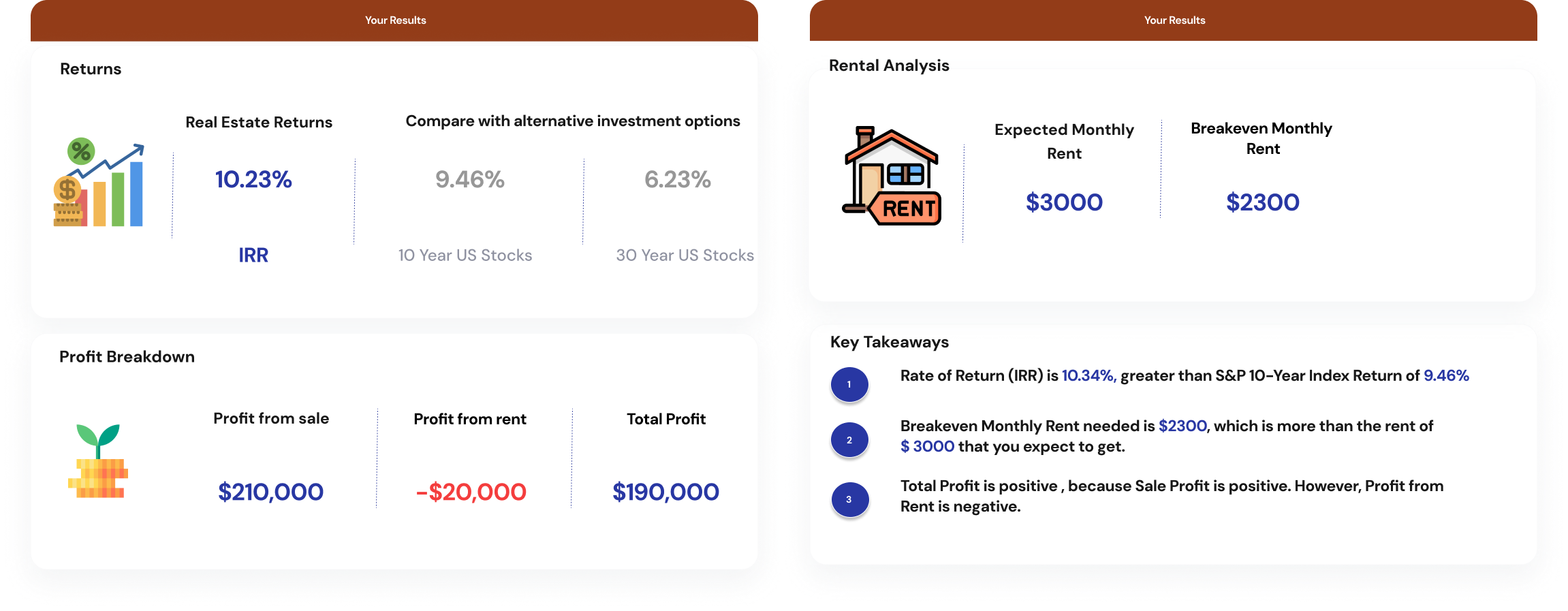

However, when considering buying rental properties, it is very important to crunch the numbers and calculate important metrics for the property such as the net operating income, Return on Investment (ROI) and Internal Rate of Return (IRR) to determine whether the investment is really worth it. You should also compare the investment to the opportunity costs, for example, the returns you would earn if you were putting this investment in stock market index funds.

First look at all income sources for the rental property. This would of course include rent, but will sometimes include additional revenue sources, if applicable, such as laundry, pet fees, clubhouse, community center, or other common facility usage fees.

It is absolutely important to look at occupancy rates. You could have good rental values, but if occupancy is not maximized then your actual rental income will be lower.

Here is an example to showcase the importance of occupancy rate:

This type of occupancy rate analysis is even more important for Airbnb or short term rental property owners where occupancy rates can be highly variable due to the short-term nature of the rentals. There are no long-term leases to guarantee a certain level of occupancy. Occupancy rate analysis will ensure that you set the right level of rent to maximize rental income and occupancy.

Rental income is taxed as ordinary income, so you have to apply standard income tax rates and calculate the net income after paying income taxes.

Next we look at all the expenses associated with the rental property. These include the more obvious ones like mortgage but should also include maintenance, property management fees and taxes. You need to make sure to include all expenses to make sure you are factoring in everything before you assess the viability of a rental property.

If you took out a loan to buy the rental property, calculate the mortgage payments that you are making.

If your equity in the rental property is below 20%, you will likely have to pay Private Mortgage Insurance (PMI). This can range from 0.3% to 1.5% of the home value.

Factor in property taxes applicable to your area. These can vary from 0.27% to 2.3% depending on the area you live in.

The property will also need regular maintenance and upkeep, which will eat into the profit. The maintenance required will depend on how old the property is and the condition it is in. There are several rules of thumb you can use to plan for maintenance expenses. The 1% rule says you should set aside 1% of the purchase cost annually. For example, if you bought a home for $500,000, set aside $5000 annually for maintenance costs. The 50% rule says to budget 50% of your monthly income for maintenance, taxes and insurance. You can also use the square-footage rule by which you set aide $1 per square foot of property per year. So a $2000 square foot apartment will require $ 2000 in annual maintenance costs.

If you are using a property management company to manage the property, they may take a certain percentage of the rental income in return for helping manage the property. Typical property management fees are between 8% to 12% of the monthly rent of the property.

For calculating the cash flow, subtract the expenses from the net income.

Cash Flow = Net Income - Expenses

Project this cash flow through the expected holding period, say 10 years and calculate the cash flow for each year.

The return on investment (ROI) measures the profitability of a property as a percentage of the investment into this property.

ROI = (Gain - Cost)/ Cost

The costs and expenses depend on whether you bought the property all-cash or whether you took out a loan to purchase it.

Original Costs

Operating Costs

Original Costs

Operating Costs

IRR is the discount rate that makes the net present value of all cash flows equal to zero. The IRR is a measure of the compounded annual growth rate (CAGR) of a real estate investment.Calculate all the cash flow on a rental property, including rental income and expenses, original investment and expected sale price after the holding period. Then run an IRR analysis.

The breakeven rent is the minimum rent you need to charge to break even on all the ongoing expenses on a property, including mortgage payments, maintenance, property taxes, HOA, management fees, etc. Once you have calculated the breakeven rental amount, look at the rents for comparable properties to determine whether you can generate enough rent to at least break even. Again, do not forget to factor in the occupancy rate to calculate the actual rental income you will likely get in a certain area vs the breakeven rent you need to charge.

As you can see, there are many factors you need to consider while evaluating a rental property including Operating Rental Income, ROI, IRR and the Breakeven Rental value. Remember to factor in non-obvious factors such as occupancy rates and income and property taxes, insurance and property management fees, in addition to the more obvious factors such as gross rental income and mortgage expenses.

Finally, compare the return on your rental income to other investments you could have made with the same money, such as stocks, to make sure that this is really the best way to deploy your money.

At Planwell, we are building a fully automated AI financial planner and advisor that will allow you to evaluate real estate investments as part of our financial planning functionality to help you make super personalized financial decisions such as real estate investing, home affordability, financial independence and kids’ college.

We will be launching the product in the coming months. Stay tuned for an update. Join our waitlist for exclusive access to the free PlanWell beta. In the meantime, check out our blog posts to help you plan your finances.