How to Buy Your First Investment Property: A Step-by-Step Guide

Photo by Avi Waxman on Unsplash

Investing in real estate can be a great way to diversify your portfolio and earn passive income. Real estate can help you generate steady cash flows and build wealth over the long term. Many folks in the Financial Independence, Retire Early (FIRE) community use real estate income as a key component of their early retirement strategy.

Types of Real Estate

Residential Property: Single family homes, condos, apartment complexes and multi-family rental units constitute residential property that you can invest in.

Commercial Property: Office property, retail complexes and units.

Vacation rentals and short term rentals: Includes renting out your property through apps platforms such as Airbnb or Vrbos.

Land: You can buy land that will potentially appreciate in value as the area around it develops.

Mixed-Use Properties: These are a combination of residential and commercial uses, such as buildings that have shops on the ground floor and apartments in all the floors above. .

If you are a first time real estate investor, here is a step-by-step guide on how to buy your first investment property and begin your journey into real estate.

Step 1: Evaluate Your Readiness to Buy Your First Investment Property

Becoming a landlord is not for everyone. Before you dive in, take the time to assess your readiness on the following dimensions:

Financial stability

Make sure you have financial stability ahead of making investment property decisions. Make sure you have steady income and cash flows, manageable debt levels and enough money for downpayment. You should also have a good credit score to help you secure loans on good terms.

Comfort with less liquidity

Investing in rental property is a long game. You have to be comfortable that you will not be able to use the real estate assets for any other purpose or any emergencies that come up. It can take a while to sell the property and if you have to sell in a rush, you may end up taking the loss or selling in a downmarket. Therefore, you should have a sizable asset allocation in liquid assets such as cash or stocks that can be easily deployed in case of emergencies, without relying on real estate.

Handling tenant & operational issues

Not everyone wants to or is cut out to be a landlord. Being a landlord comes with responsibility towards your tenants. You may be woken up in the night over a plumbing issue in the property. Or there may be disputes between tenants or damage caused to the property by irresponsible tenants.

Property management companies can solve this issue by handling the operational effort of managing your rental property but you will have to pay them a percentage of your rental income, typically around 10%.

Step 2: Market Analysis for Your First Investment Property

It is important to invest in a good rental market. There are many factors that need to be considered when analyzing rental markets, including location near job hubs, rental values, amenities, school quality, property taxes and last but not the least, solid economic growth and jobs. These factors will increase your chances of good rental income, ensure high occupancy rates and property appreciation over the long term.

Additionally you should also carefully study state and city regulations covering landlord/ tenant relationships, price controls and other legal factors that could impact your property value and income potential.

Find out the going rents in your target area through properties such as Zillow and MLS listings. If you are looking to let your property via short term rentals, study the going rates on Airbnb or similar sites.

Step 3: Evaluate Eligibility For Financing

There are multiple factors that determine whether you are eligible for financing and how much financing you can get.

Debt-to-Income Ratio

Debt-to-Income ratios are used by lenders to assess your creditworthiness and ability to pay back loans.

Front-end debt-to-income ratio

The debt to income is calculated by taking all housing debt and dividing it by gross income. Typically it is recommended that this ratio be 28% or less. If you’d like to see how these guidelines affect affordability, check out how much house can I afford with a $60,000 salary.

Back-end debt-to-income ratio

The backend debt to income ratio accounts for all debt, including housing, student loans, car loans and any personal loans. It is recommended that this be 36% or less.

Credit score

A higher credit score not only can help with getting away with a lower down payment but also helps secure best mortgage interest rates. Generally, you need to have a credit score of at least 680+ to be eligible for good interest rates.

Down Payment amount

Make sure you have the necessary down payment amount saved up. The downpayment on an investment property is not the same as for a primary residence, since investment properties are considered more risky. Lenders will typically expect at least a 15% to 20% down payment. For multi-family rental units, they may expect as much as 25% to 30%.

Step 5: Test the waters

Start with a smaller Property

Starting with a single family home or a smaller unit can help you learn the ropes of real estate investing before you start handling larger units.

House hacking

Since this is your first investment property, you may wish to test the waters by using techniques such as house hacking. House hacking refers to the act of generating rental income while living in the property you are renting out. This may take the form of acquiring roommates, living in one rental unit while renting out others in a multi-family rental, or even through short term rentals such as Airbnb or Vrbo. Your tenants will pay some or all of the mortgage and part of utility bills. This generates cash flow and passive income that makes the real estate investment more affordable and improves the return on the investment. House hacking can also be part of a Barista FIRE approach if you’d like to transition to part-time work while building passive income.

Step 6: Find an agent or property management company

An agent or property manager can make the operational management of the property and resolving tenant issues much easier and take these tasks off your hands. This is especially true if you live away from your property and want someone hands-on to take care of the maintenance and address tenant issues.

If you have a single-family home, you could consider hiring an individual property manager. A multi-family property may necessitate hiring a property management company. Typically property managers will charge about 10% of the rental income. While calculating the ROI and cash flows on the property, be sure to factor in the property management costs.

You can find a property management firm through referrals or job postings. Look up their reviews or ask for testimonials from their other clients to ensure you make the right decision. You can also visit buildings or properties managed by the property management companies and check out how they manage them.

Step 7: Crunch The Numbers

The following are important metrics used to analyze real estate investments.

Return-on-Investment (ROI)

The return on investment (ROI) on rental properties measure the profitability of the property. It is calculated as follows:

ROI = (Gain-Cost)/ Cost

Gains include:

(1) Rental Income

(2) Property appreciation

Cost includes:

(1) Initial investment, including purchase price, closing costs, renovations and remodeling

(2) Ongoing Expenses such as taxes, maintenance, property management fees, insurance and many others.

Breakeven Rent

Calculate the minimum rent you need to charge to break even on the property expenses. When you do your market analysis, make sure that the going rents in an area will be at least equal to or greater than the breakeven rent.

Capitalization Rate

The Capitalization or Cap Rate is defined as the Net Operating income as a percentage of current market value of the property.

Cap Rate = Net Operating Income (NOI)/ Current Market Value of Property

Net operating income = Annual income from the property – Expenses (maintenance, taxes, etc)

A higher cap rate indicates that the return is higher, but the investment comes with more risk. For example, in a fast-growing market with a lot of jobs, the market value of the investment could be higher, therefore the cap rate is lower than another property with lower market value in a less prosperous area.

Step 8: Understand The Risks Of Real Estate Investing

Lack Of Liquidity

Real estate means your investment is not liquid. So if you need money in a crunch, you cannot sell immediately like you can for stocks. A quick sale may necessitate selling at a loss.

Mitigation

Make sure you have enough emergency reserves and liquid assets that can help cover any emergencies. Ideally you’d want to diversify into real estate after investing in more liquid options such as stocks or mutual funds.

If liquidity is a concern, you can consider publicly traded REITs as a way to be invested in real estate while maintaining liquidity and being able to sell quickly.

Unpredictable Market Value

You may expect the housing market to keep going up. However, this is not always the case. Housing markets can show volatility or go down because of macroeconomic factors such as a recession. They can also go down due to a location or neighborhood going through a downturn, demographic changes and so on.

Mitigation

Do your research into the location and the various factors determining real estate value in a given location, such as local economy, schools and crime. You may not be able to predict or control macroeconomic factors such as a recession. But try not to get carried away and pay more for real estate in a frothy real estate market. Also maintain a healthy mix of cash and stocks to help you ride through a recession without having to do a fire sale of your real estate property.

Negative cash flows

Negative cash flows on rental property can happen when the money coming in through rental income is lesser than the mortgage, maintenance, taxes and other expenses. There can be many reasons for a negative cash flow, including higher vacancy rates or lower rental income than expected, or the need for additional maintenance or remodeling. Underestimating these expenses is one of the 5 common money mistakes to avoid for new investors.

Mitigation

Do a thorough analysis of all potential expenses before you buy so that you are sure about a good cash flow. Do a what-if scenario analysis and make sure you can handle negative scenarios.

Vacancy rate

A high vacancy rate is a significant risk in owning rental property, especially if you depend on the rental income to cover mortgage and expenses. This is why it is important to evaluate the location and to ensure that there is a healthy economy in the area that generates high demand for housing.

Mitigation

Research the occupancy rates in the neighborhood for comparable properties. Allow for an additional buffer in vacancy rates so that your cash flows are still positive in case vacancy rates should go down.

Maintenance and Remodeling

There could be unanticipated maintenance or remodeling work required which can suck up a huge amount of cash and negatively impact the return on investment and cash flow.

Mitigation

This is why before you buy rental property, it is absolutely essential to do a thorough inspection to analyze any structural, pest mold or any other issues the property may have.

Conclusion

As you can see, real estate investing has many benefits including generating passive income, steady cash flows and portfolio diversification and providing long term asset appreciation. However, before you take the leap and invest in your first real estate property, you should take the time to evaluate your readiness for real estate investing. Analyze the market and crunch the numbers carefully, including ROI, cap rates and breakeven rent, and make sure to model negative market scenarios as part of your analysis.

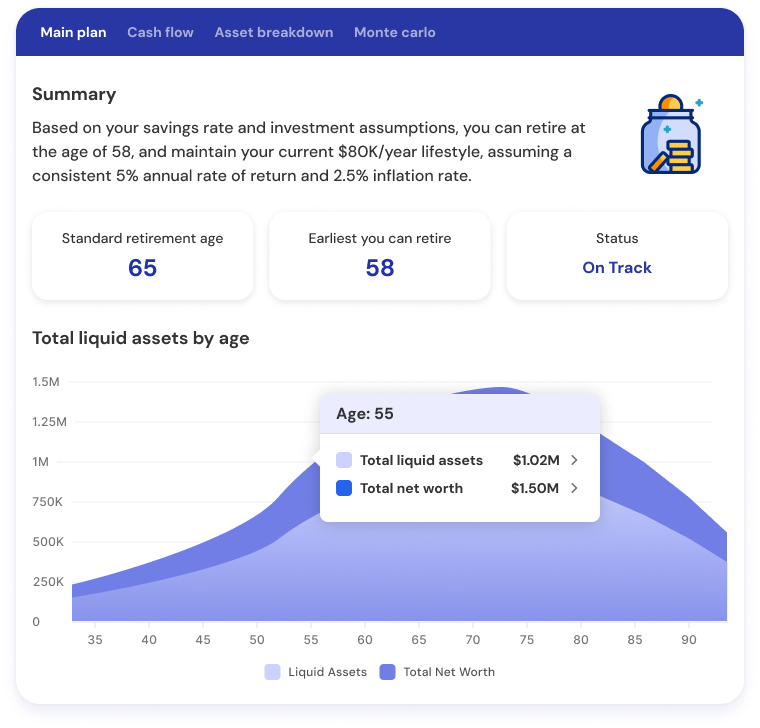

At Planwell, we are building a fully automated AI financial planner and advisor to help you make super personalized financial decisions such as how much house you can afford, while considering your lifestyle, retirement goals and other key factors.

We will be launching the product very soon. Stay tuned for an update. In the meantime, check out our blog posts to help you plan your finances.

- How Much House Can I Afford: Review our blog post on all the factors that determine your home affordability.

- How to calculate rental income: A complete guide for new landlords.

- House Hacking: The complete guide to house hacking.

- How to build a personal financial plan: Before you make a home purchase, make sure to build your personalized financial plan with our 10 step guide.

- How to Use AI Budget Calculators and Tools to Plan Your Finances: Take advantage of modern technology to plan your finances more effectively.

- How much home can I afford: Calculate home affordability using standard debt-to-income ratios and your own personal financial situation and lifestyle.

Related Posts

About

©2023 Planwell.io