While thinking about how much house you can afford, there are many important considerations. Lenders will consider standard metrics such as debt-to-income ratios and expect that not more than 28% of gross income is spent on all home related expenses or not more than 36% of gross income be spent on all loans and debt, including home loans. Additionally, they also look at your gross income and how much down payment you can afford, in order to determine how much home value they will approve you for. And of course, interest rates and property tax rates are also an important determinant of how much home you can afford..

However not all individuals and families are the same, so what works for one individual or family may not work for another, even if the debt-to-income ratios or gross income are the same. It is important to think about your lifestyle, expenses and other goals you might have. For example, if you want to retire early or fully fund kids’ college, you might decide to buy a less expensive home. Or if you really want that nice house in a great neighborhood, you may choose to spend more on housing and cut back on many other expenses and hobbies. At the end of the day, our lifestyle, expenses and income are the biggest determinants of home affordability.

Consider someone with an income of $100,000 and monthly car or student loans of $400. Assuming mortgage rates of 6.72% and down payment of $50,000, you may be approved for $383,000 with a debt-to-income ratio of 36%.

But is this the right home value for everyone with the same income?

What if you are a frugal person and can control your living expenses? In that case you may be able to afford a more expensive home. Or alternatively, if you tend to have a higher expense level, you may only be able to afford a lower home value.

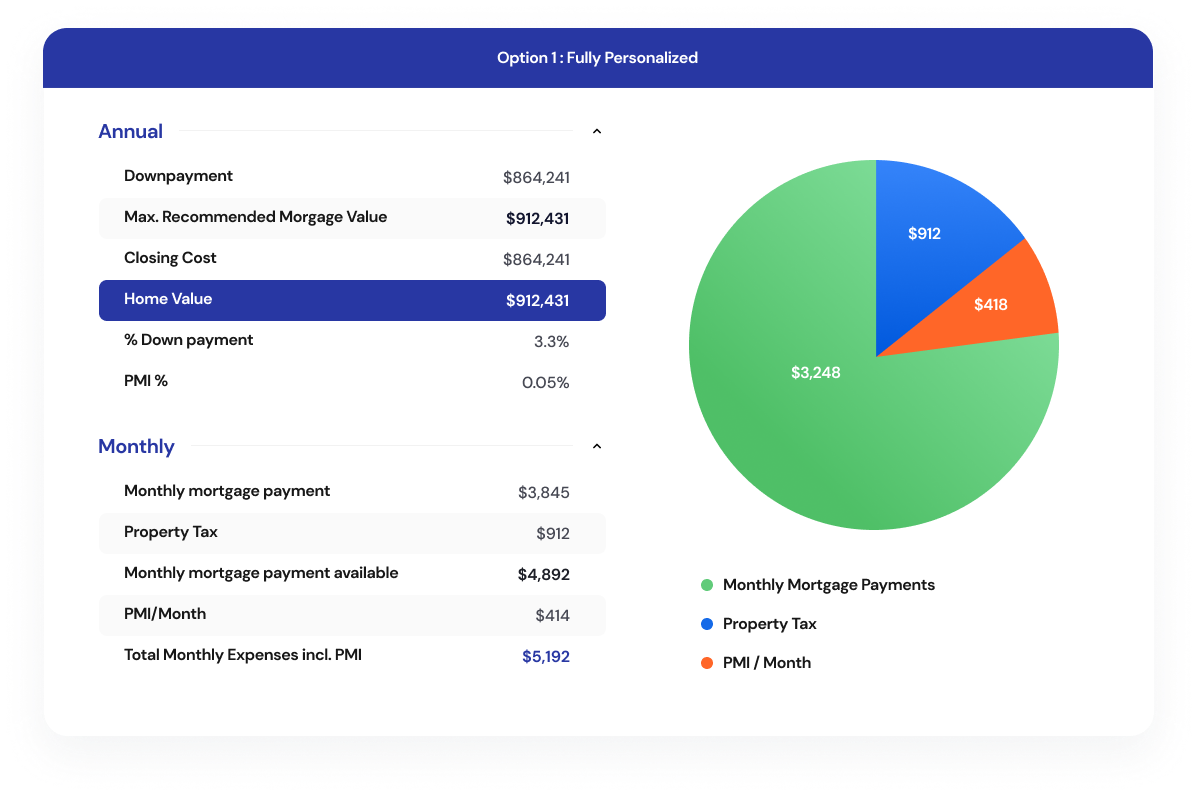

Let us consider a few different scenarios.

Now imagine your salary takes a big jump and you can achieve an income of $200K per year. Of course you’d expect your home affordability number to improve significantly. We make the same assumptions as earlier and keep things simple.

Now consider someone with an income of $80,000 per year. Let us make similar assumptions that they put away 10% of their gross income towards 401K, and they have saved up $50,000 for down payment. Now let us crunch the numbers.

Again, to keep things simple, we go with the same assumptions of down payment, interest rates and 401K savings rate as before. Let us see how the numbers stack up.

So as you can see, it would be wise to make a home affordability decision based on many nuanced factors such as your lifestyle and expense levels – and not just rely on standard rules of thumb, which may not take into account your personal situation. Additionally, you should also think about other goals such as retirement or college savings for kids. These may also influence whether you want to spend more on a home – or not.

By making sure you plan your finances and your future goals, you can figure out the right amount to spend on a new home, tailored to your unique situation.

Start planning now and let your future self thank you!